Day 7: Income Inequality

According to respondents of a September 2020 national poll, 72 percent of Latino households, 60 percent of Black households, and 55 percent of Native American households are facing serious financial problems since the pandemic began, compared to 36 percent of white households. “Everything that we’ve seen laid bare by the pandemic has had a long history, whether it’s health inequality, wealth inequality, income inequality, policing inequality,” says economist Lisa Cook.

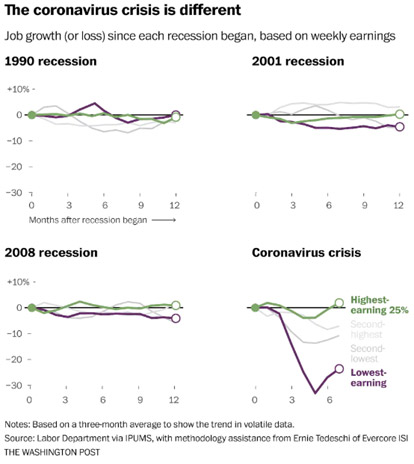

A Washington Post analysis of job losses across the income spectrum shows that while the nation overall has regained nearly half of the lost jobs, several key demographic groups have recovered much more slowly, including mothers of school-age children, Black men, Black women, Hispanic men, Asian Americans, younger Americans (ages 25 to 34) and people without college degrees (source).

This economic crisis is the most unequal recession in modern U.S. history, delivering a mild setback for those making middle to high wages and a depression-like blow for the ALICE (Asset Limited, Income Constrained, Employed) population, who are disproportionately employed in industries hit hardest. Covid-19 has exposed critical shortcomings in our economy and across all systems showing just how exposed ALICE households – especially those at the intersections of race and gender – are to severe crisis. It has also presented us with an opportunity to reimagine and rebuild our communities in ways that are inclusive and equitable for all.

Over the next few days, we will be exploring how ALICE, race, and other factors impact a person’s housing, health, education, and financial stability.

Today’s Challenge

Read: Check out the United for ALICE dashboard to better understand the disproportionate impacts Covid-19 has had on the ALICE population.

Read: Read “Rebuild better: A framework to support an equitable recovery from Covid-19” for actionable ideas to rebuild better, generating higher-quality job and wealth creation opportunities in our local economy that advance racial inclusion and long term resilience.

Read: Read about Raj Chetty, a Harvard economist committed to showing how zip code shapes opportunity. Dive into our local Michigan data with The Opportunity Insights Economic Tracker: Supporting the Recovery from Covid-19.

Discussion

We learned that in Michigan, 63 percent of Black households fall below the ALICE Threshold (the minimum income needed to afford household basics), struggling to cover expenses including housing, childcare, food, transportation, health care and utilities. That is nearly double the number of white households – 39 percent – experiencing similar financial hardship.

From 2010 to 2018, the number of Black households below the ALICE Threshold increased by 11%, while the number of White households struggling to make ends meet increased by only 1% in Michigan.

What are the consequences of growing racial income inequality?

What significance does this have for wealth building across generations?